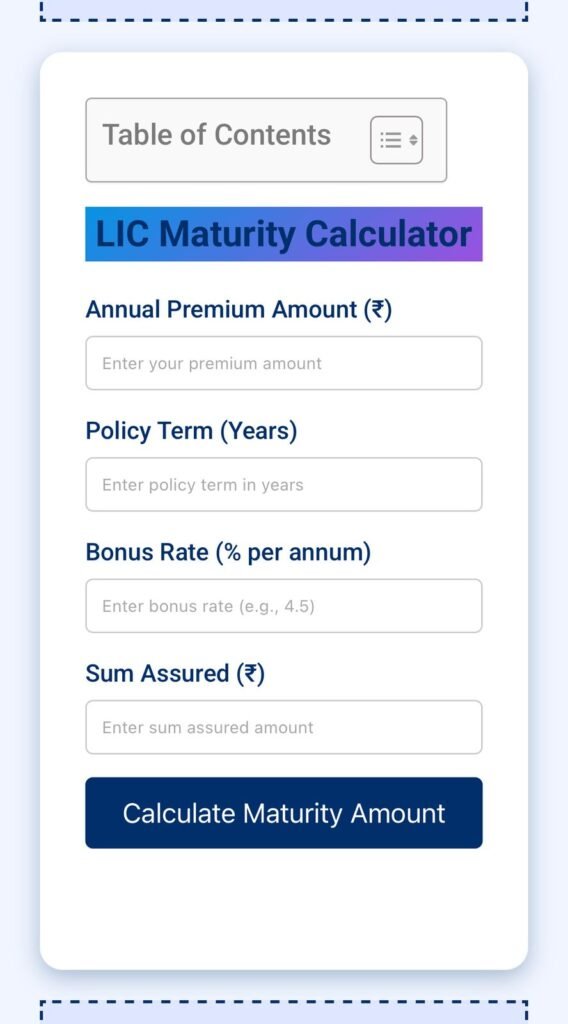

How to Use LIC Maturity Calculator?

The LIC Maturity Calculator is an easy-to-use tool that helps you estimate the maturity amount of your LIC policy. Simply enter your annual premium, policy term, and expected rate of return. Click on the “Calculate Maturity Amount” button, and the tool will show you the maturity amount based on the inputs.

Why is the LIC Maturity Calculator Important?

Planning your finances is crucial for a secure future. The LIC Maturity Calculator helps you:

- Estimate your LIC policy returns accurately.

- Plan your investments effectively.

- Understand the benefits of compounding.

- Make informed financial decisions.

Use our LIC Maturity Calculator today to stay ahead in your financial planning journey!

keywords

LIC calculator

LIC policy calculator

LIC maturity calculatorJeevan Anand calculatorJeevan Saral calculatorLIC premium calculatorLIC interest calculatorLIC scheme calculatorLIC online calculatorLIC insurance calculatorLIC returns calculatorOld Jeevan Anand maturity calculatorJeevan Anand policy calculatorLIC calculator appLIC calculator onlineLIC policy details calculatorLIC maturity amount calculatorLIC premium amount calculatorLIC interest rate calculatorLIC scheme details calculatorLIC Jeevan Anand policy calculatorLIC Jeevan Saral maturity calculatorLIC online premium calculatorLIC insurance policy calculatorLIC returns on investment calculatorLIC scheme benefits calculatorLIC policy status calculatorLIC claim status calculatorLIC loan calculatorLIC surrender value calculator

LIC Calculator: Your Ultimate Guide to LIC Policy Calculations

Life Insurance Corporation of India (LIC) offers various insurance policies that help secure the financial future of individuals and their families. Understanding the calculations related to premiums, maturity amounts, interest rates, and returns is essential for policyholders. This is where an LIC calculator becomes invaluable.

What is an LIC Calculator?

An LIC policy calculator is an online tool that helps users estimate their LIC premium amount, maturity amount, interest, and returns before investing in a policy. The LIC online calculator ensures transparency and allows individuals to compare different schemes based on their requirements.

Types of LIC Calculators

Different LIC policies require different types of calculations. Here are some commonly used LIC calculators:

1. LIC Premium Calculator

The LIC premium calculator helps users determine the premium amount they need to pay for their policy. By entering details such as sum assured, policy term, and age, individuals can get an accurate estimate of their LIC premium amount.

2. LIC Maturity Calculator

The LIC maturity calculator computes the amount a policyholder will receive at the end of the policy term. The LIC maturity amount calculator factors in the sum assured, bonuses, and interest rates to give an estimate.

3. LIC Interest Calculator

The LIC interest calculator helps users determine the interest accrued on their LIC policy over time. This is particularly useful for investment-related LIC schemes.

4. LIC Returns Calculator

A LIC returns on investment calculator evaluates the total returns a policyholder will receive from their LIC policy, including bonuses and interest.

5. LIC Jeevan Anand Calculator

The Jeevan Anand calculator is specifically designed to estimate premiums, maturity amounts, and benefits of the LIC Jeevan Anand policy. It also includes the Old Jeevan Anand maturity calculator for individuals who hold older versions of the policy.

6. LIC Jeevan Saral Calculator

The Jeevan Saral calculator helps users understand the returns and benefits of the LIC Jeevan Saral policy. It includes the LIC Jeevan Saral maturity calculator for maturity-related calculations.

7. LIC Loan Calculator

Many LIC policyholders avail loans against their policies. The LIC loan calculator helps them determine the eligible loan amount based on their policy’s surrender value.

8. LIC Surrender Value Calculator

If a policyholder decides to terminate their LIC policy before maturity, the LIC surrender value calculator calculates the amount they will receive.

9. LIC Policy Status Calculator

The LIC policy status calculator allows users to check their policy details, payment history, and overall policy status.

10. LIC Claim Status Calculator

Policyholders can use the LIC claim status calculator to check the status of their claim settlement process.

Benefits of Using an LIC Online Calculator

-

Time-Saving: Avoid manual calculations and get instant results.

-

Accuracy: Get precise estimates for premiums, maturity amounts, and returns.

-

Easy Comparison: Compare different LIC schemes before investing.

-

Financial Planning: Helps users plan their investments efficiently.

How to Use an LIC Calculator Online?

Using an LIC calculator online is simple and involves the following steps:

-

Visit the LIC official website or a trusted financial portal offering LIC calculators.

-

Select the type of LIC insurance calculator you need (premium, maturity, interest, etc.).

-

Enter required details such as age, sum assured, policy term, and premium payment mode.

-

Click on ‘Calculate’ to get instant results.

LIC Calculator App

For added convenience, LIC offers a LIC calculator app that allows users to perform policy-related calculations on their smartphones.

Conclusion

An LIC scheme calculator is an essential tool for anyone considering an LIC policy. Whether you need a LIC premium amount calculator, a LIC scheme benefits calculator, or a LIC online premium calculator, these tools help you make informed financial decisions. Utilize an LIC insurance policy calculator today and plan your investments wisely!